Latest Publications

-

Working Paper No. 1103January 08, 2026

Legal Tender, Debt, and the Institutional Settlement of Monetary Obligations in English Law

-

Policy Note No. 2025/10December 22, 2025

The Fed Lowered Rates Again. Is It Really a Surprise?

-

Working Paper No. 1102December 12, 2025

No More than Double: Can a Single Rule Tame Capitalism?

-

Policy Note No. 2025/9November 24, 2025

Democratic Renewal and the Green Job Guarantee

-

Working Paper No. 1101November 18, 2025

Currencies Come and Go, but Employment Always Takes Root

News & Events

News

December 18, 2025

An Open Letter to the Indian Government in Support of the Mahatma Gandhi National Rural Employment...

News

December 18, 2025

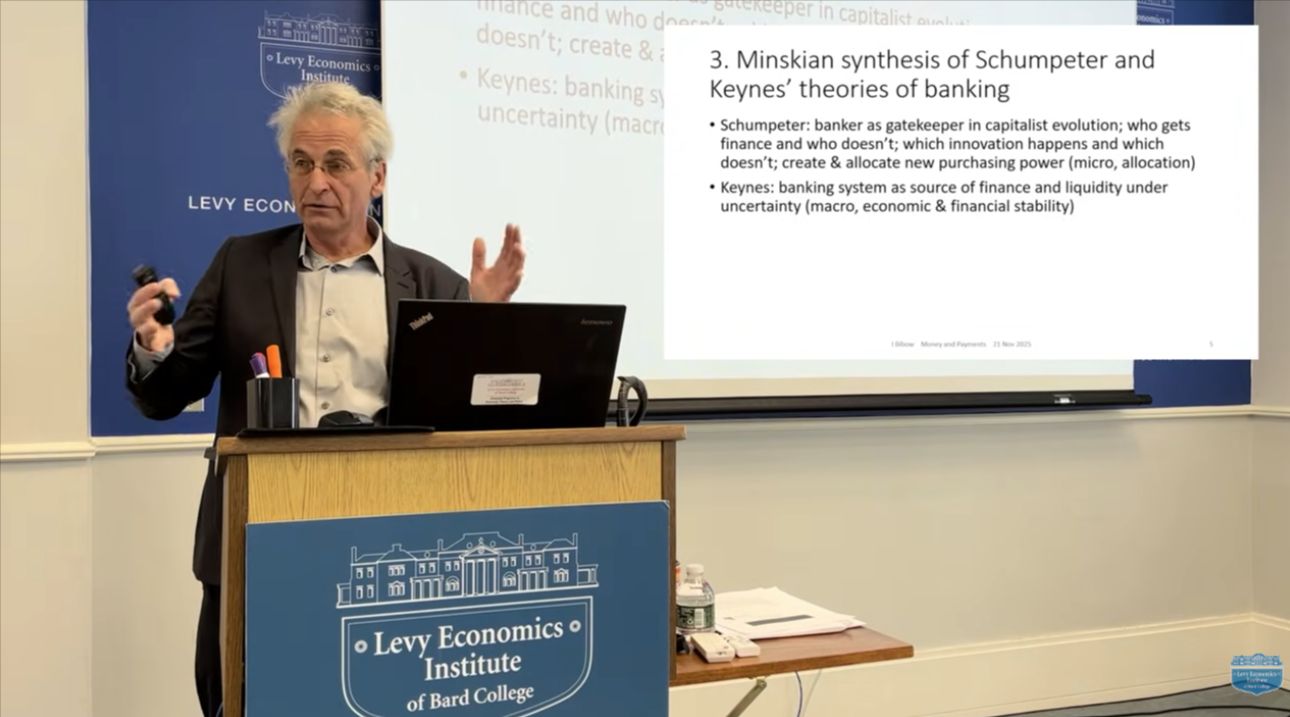

Watch Video of Jörg Bibow’s Levy Institute Lecture, “Money & Payments: Evolution or Revolution?”

News

October 30, 2025

Featured Commentary

Levy Institute Capitol Hill Series: Rethinking the Federal Reserve’s Policy Framework and Independence

New Levy Institute Podcast Out Now: Nancy Folbre

Employment Guarantee on the Block

Jean DrèzeKeeping Up with Household Debt in the US

Francesco Ruggeri, Riccardo Pariboni, and Giuliano T. Yajima