Publications

Asia's revenge

By Martin Wolf

October 8, 2008. Copyright 2008 The Financial Times Limited. “FT” and “Financial Times” are trademarks of the Financial Times.

“Things that can’t go on forever, don’t.” —Herbert Stein, former chairman of the US presidential Council of Economic Advisers

What confronts the world can be seen as the latest in a succession of financial crises that have struck periodically over the last 30 years. The current financial turmoil in the US and Europe affects economies that account for at least half of world output, making this upheaval more significant than all the others. Yet it is also depressingly similar, both in its origins and its results, to earlier shocks.

To trace the parallels—and help in understanding how the present pressing problems can be addressed—one needs to look back to the late 1970s. Petrodollars, the foreign exchange earned by oil exporting countries amid sharp jumps in the crude price, were recycled via western banks to less wealthy emerging economies, principally in Latin America.

This resulted in the first of the big crises of modern times, when Mexico’s 1982 announcement of its inability to service its debt brought the money-centre banks of New York and London to their knees.

Carmen Reinhart of the University of Maryland and Kenneth Rogoff of Harvard University identify the similarities in a paper published earlier this year.* They focus on previous crises in high-income countries. But they also note characteristics that are shared with financial crises that have occurred in emerging economies.

This time, most emerging economies have been running huge current account surpluses. So a “large chunk of money has effectively been recycled to a developing economy that exists within the United States’ own borders,” they point out. “Over a trillion dollars was channelled into the subprime mortgage market, which is comprised of the poorest and least creditworthy borrowers within the US. The final claimaint is different, but in many ways the mechanism is the same.”

The links between the financial fragility in the US and previous emerging market crises mean that the current banking and economic traumas should not be seen as just the product of risky monetary policy, lax regulation and irresponsible finance, important though these were. They have roots in the way the global economy has worked in the era of financial deregulation. Any country that receives a huge and sustained inflow of foreign lending runs the risk of a subsequent financial crisis, because external and domestic financial fragility will grow. Precisely such a crisis is now happening to the US and a number of other high-income countries including the UK.

These latest crises are also related to those that preceded them—particularly the Asian crisis of 1997–98. Only after this shock did emerging economies become massive capital exporters. This pattern was reinforced by China’s choice of an export-oriented development path, partly influenced by fear of what had happened to its neighbours during the Asian crisis. It was further entrenched by the recent jumps in the oil price and the consequent explosion in the current account surpluses of oil exporting countries.

The big global macroeconomic story of this decade was, then, the offsetting emergence of the US and a number of other high-income countries as spenders and borrowers of last resort. Debt-fuelled US households went on an unparalleled spending binge by dipping into their housing “piggy banks.”

In explaining what had happened, Ben Bernanke, when still a governor of the Federal Reserve rather than chairman, referred to the emergence of a “savings glut.” The description was accurate. After the turn of the millennium, one of the striking features became the low level of long-term nominal and real interest rates at a time of rapid global economic growth. Cheap money encouraged an orgy of financial innovation, borrowing and spending.

That was also one of the initial causes of the surge in house prices across a large part of the high-income world, particularly in the US, the UK and Spain.

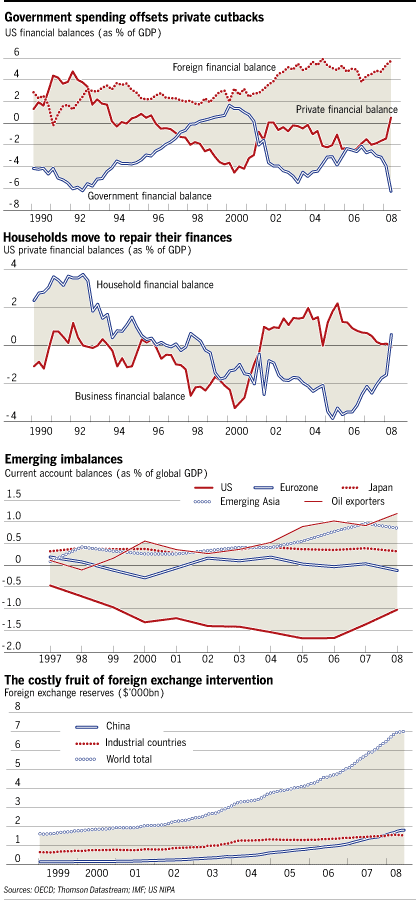

What lay behind the savings glut? The first development was the shift of emerging economies into a large surplus of savings over investment. Within the emerging economies, the big shifts were in Asia and in the oil exporting countries (see chart). By 2007, according to the International Monetary Fund, the aggregate savings surpluses of these two groups of countries had reached around 2 per cent of world output.

Despite being a huge oil importer, China emerged as the world’s biggest surplus country: its current account surplus was $372bn (£215bn, €272bn) in 2007, which was not only more than 11 per cent of its gross domestic product, but almost as big as the combined surpluses of Japan ($213bn) and Germany ($185bn), the two largest high-income capital exporters.

Last year, the aggregate surpluses of the world’s surplus countries reached $1,680bn, according to the IMF. The top 10 (China, Japan, Germany, Saudi Arabia, Russia, Switzerland, Norway, Kuwait, the Netherlands and the United Arab Emirates) generated more than 70 per cent of this total. The surpluses of the top 10 countries represented at least 8 per cent of their aggregate GDP and about one-quarter of their aggregate gross savings.

Meanwhile, the huge US deficit absorbed 44 per cent of this total. The US, UK, Spain and Australia—four countries with housing bubbles—absorbed 63 per cent of the world’s current account surpluses.

That represented a vast shift of capital—but unlike in the 1970s and early 1980s, it went to some of the world’s richest countries. Moreover, the emergence of the surpluses was the result of deliberate policies—shown in the accumulation of official foreign currency reserves and the expansion of the sovereign wealth funds over this period.

Quite reasonably, the energy exporters were transforming one asset—oil—into another—claims on foreigners. Others were recycling current account surpluses and private capital inflows into official capital outflows, keeping exchange rates down and competitiveness up. Some described this new system, of which China was the most important proponent, as “Bretton Woods II,” after the pegged adjustable exchange rates set-up that collapsed in the early 1970s. Others called it “export-led growth” or depicted it as a system of self-insurance.

Yet the justification is less important than the consequences. Between January 2000 and April 2007, the stock of global foreign currency reserves rose by $5,200bn. Thus three-quarters of all the foreign currency reserves accumulated since the beginning of time have been piled up in this decade. Inevitably, a high proportion—probably close to two-thirds—of these sums were placed in dollars, thereby supporting the US currency and financing US external deficits.

The savings glut had another dimension, related to a second financial shock—the bursting of the dot-com bubble in 2000. One consequence was the move of the corporate sectors of most high-income countries into financial surplus. In other words, their retained earnings came to exceed their investments. Instead of borrowing from banks and other suppliers of capital, non-financial corporations became providers of finance.

In this world of massive savings surpluses in a range of important countries and weak demand for capital from non-financial corporations, central banks ran easy monetary policies. They did so because they feared the possibility of a shift into deflation. The Fed, in particular, found itself having to offset the contractionary effects of the vast flow of private and, above all, public capital into the US.

A simple way of thinking about what has happened to the global economy in the 2000s is that high-income countries with elastic credit systems and households willing to take on rising debt levels offset the massive surplus savings in the rest of the world. The lax monetary policies facilitated this excess spending, while the housing bubble was the vehicle through which it worked.

The charts show what happened, as a result, to “financial balances”—the difference between expenditure and income inside the US economy. If one looks at three sectors—foreign, government and private—it is evident that the first has had a huge surplus this decade—offset, as it has to be, by deficits in the other two.

In the early 2000s, the US fiscal deficit was the main offset. In the middle years of the decade, the private sector ran a large deficit while the government’s shrank. Now that the recession-hit private sector is moving back into balance at enormous speed, the government deficit is exploding once again.

Looking at what happened inside the private sector, a striking contrast can be seen between the corporate and household realms. Households moved into a huge financial deficit, which peaked at just under 4 per cent of GDP in the second quarter of 2005. Then, as the housing bubble burst, housebuilding collapsed and households started saving more. With remarkable speed, the household financial deficit disappeared. Today’s explosion in the fiscal deficit is the offset.

Inevitably, huge household financial deficits also mean huge accumulations of household debt. This was strikingly true in the US and UK. In the process, the financial sector accumulated an ever greater stock of claims not just on other sectors but on itself. This frightening complexity, which lies at the root of many of the current difficulties, was facilitated by the environment of easy borrowing and search for high returns in an environment of low real rates of interest. These linked dangers between external and internal imbalances, domestic debt accumulations and financial fragility were foretold by a number of analysts. Foremost among them was Wynne Godley of Cambridge University in his prescient work for the Levy Economics Institute of Bard College, which has laid particular stress on the work of the late Hyman Minsky.**

So what might—and should—happen now? The big danger, evidently, is of a financial collapse. The principal offset, in the short run, to the inevitable cuts in spending in the private sector of the crisis-afflicted economies will also be vastly bigger fiscal deficits.

Fortunately, the US and the other afflicted high-income countries have one advantage over the emerging economies: they borrow in their own currencies and have creditworthy governments. Unlike emerging economies, they can therefore slash interest rates and increase fiscal deficits.

Yet the huge fiscal boosts and associated government recapitalisation of shattered financial systems are only a temporary solution. There can be no return to business as usual. It is, above all, neither desirable nor sustainable for global macroeconomic balance to be achieved by recycling huge savings surpluses into the excess consumption of the world’s richest consumers. The former point is self-evident, while the latter has been demonstrated by the recent financial collapse.

So among the most important tasks ahead is to create a system of global finance that allows a more balanced world economy, with excess savings being turned into either high-return investment or consumption by the world’s poor, including in capital-exporting countries such as China. A part of the answer will be the development of local-currency finance in emerging economies, which would make it easier for them to run current account deficits than proved to be the case in the past three decades.

It is essential in any case for countries in a position to do so to expand domestic demand vigorously. Only in this way can the recessionary impulse coming from the corrections in the debt-laden countries be offset.

Yet there is a still bigger challenge ahead. The crisis demonstrates that the world has been unable to combine liberalised capital markets with a reasonable degree of financial stability. A particular problem has been the tendency for large net capital flows and associated current account and domestic financial balances to generate huge crises. This is the biggest of them all.

Lessons must be learnt. But those should not just be about the regulation of the financial sector. Nor should they be only about monetary policy. They must be about how liberalised finance can be made to support the global economy rather than destabilise it.

This is no little local difficulty. It raises the deepest questions about the way forward for our integrated world economy. The learning must start now.

*“Is the 2007 US subprime financial crisis so different? An international historical comparison.” Working paper 13761, www.nber.org

**The US economy: Is there a way out of the woods? November 2007, www.levyinstitute.org

The writer is the FT’s chief economics commentator and author of Fixing Global Finance, published in the US this month by Johns Hopkins University Press and forthcoming in the UK through Yale University Press.